Maximizing Tax Benefits: Strategies for Immigrant Business Owners in California

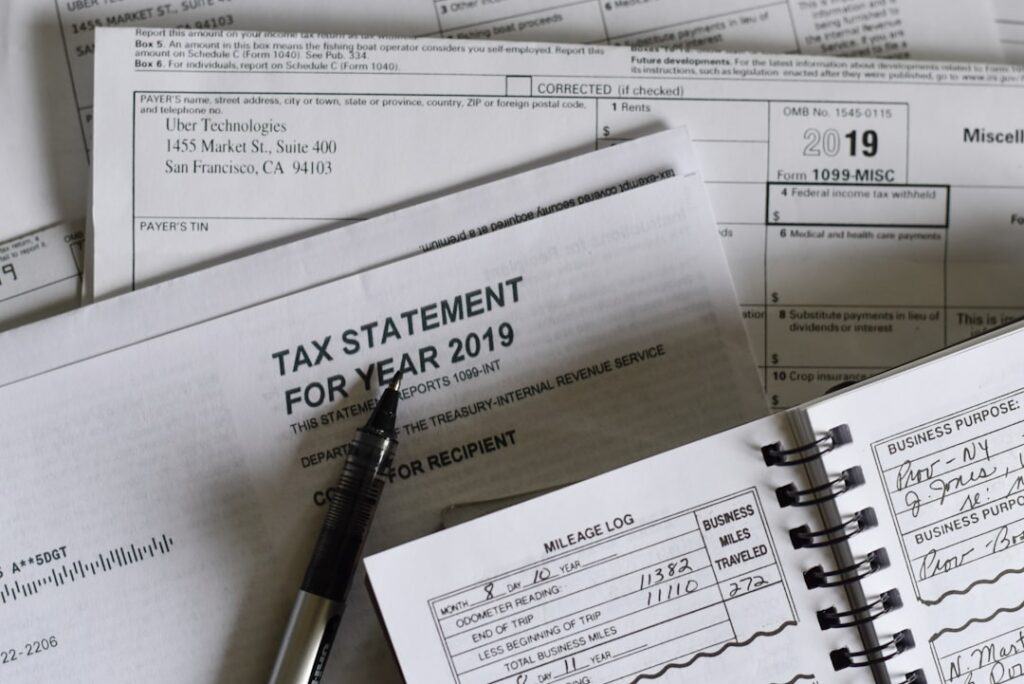

Immigrant business owners face unique challenges when navigating the complex U.S. tax system. The tax laws vary at federal, state, and local levels, making compliance crucial to avoid penalties or potential deportation.

Understanding Internal Revenue Service (IRS) guidelines is essential for these entrepreneurs, as they dictate income taxation, taxable income definitions, and required forms. Residency status significantly impacts tax liabilities for immigrant business owners. Non-resident aliens are taxed differently than resident aliens, making it vital to understand these distinctions for compliance and financial planning.

International tax treaties between the United States and other countries can provide benefits such as reduced tax rates or exemptions from double taxation. Immigrant entrepreneurs should research or seek professional assistance to take advantage of applicable treaties. Understanding tax laws related to foreign investments and income is crucial for those with financial ties to their home countries.

By gaining a comprehensive understanding of these tax laws, immigrant business owners can better position themselves for success while minimizing their tax liabilities. Proper knowledge and compliance with tax regulations are essential for the long-term success of immigrant-owned businesses in the United States.

Key Takeaways

- Understanding tax laws is crucial for immigrant business owners to ensure compliance and minimize tax liabilities.

- Leveraging tax credits and deductions can help immigrant business owners reduce their tax burden and maximize their financial resources.

- Establishing proper business structures, such as LLCs or S-Corporations, can provide tax benefits and liability protection for immigrant business owners.

- Utilizing tax-advantaged retirement accounts, such as SEP IRAs or Solo 401(k)s, can help immigrant business owners save for retirement while reducing their taxable income.

- Taking advantage of opportunity zones can provide tax incentives for immigrant business owners who invest in designated economically distressed areas.

- Navigating state and federal tax incentives is essential for immigrant business owners to capitalize on available tax breaks and credits.

- Seeking professional tax advice from a qualified accountant or tax advisor can help immigrant business owners navigate complex tax laws and maximize their tax benefits.

Leveraging Tax Credits and Deductions

Maximizing Tax Credits

Immigrant entrepreneurs should actively seek out available credits that align with their business activities and employee benefits. For instance, credits such as the Small Business Health Care Tax Credit can provide significant savings for businesses that offer health insurance to their employees. Additionally, many states offer their own credits aimed at encouraging local business growth, which can further enhance financial viability.

The Importance of Deductions

On the other hand, deductions can also play a pivotal role in managing tax liabilities. Business expenses such as rent, utilities, and employee wages can often be deducted from taxable income, thereby lowering the overall tax obligation. Immigrant business owners should maintain meticulous records of all expenses related to their operations to ensure they can substantiate their claims during tax season.

Optimizing Financial Strategies

By leveraging both tax credits and deductions effectively, immigrant entrepreneurs can optimize their financial strategies and reinvest those savings back into their businesses. Furthermore, understanding which expenses qualify for deductions—such as home office expenses or vehicle use—can lead to substantial savings.

Establishing Proper Business Structures for Tax Benefits

The choice of business structure is a critical decision for immigrant entrepreneurs that can have lasting implications on their tax obligations. Common structures include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each with its own set of tax implications. For instance, while sole proprietorships are simpler to manage and report taxes on, they do not provide personal liability protection.

In contrast, forming an LLC or corporation may offer limited liability but comes with more complex tax filing requirements. Immigrant business owners must carefully evaluate their options based on factors such as the nature of their business, potential growth trajectories, and personal financial situations. Additionally, the selection of a business structure can influence eligibility for certain tax benefits and incentives.

For example, S corporations allow profits to pass through to shareholders without being subject to corporate taxes, which can be advantageous for small businesses looking to minimize their tax burden. Conversely, C corporations face double taxation on profits—once at the corporate level and again when dividends are distributed to shareholders. Immigrant entrepreneurs should consult with legal and financial advisors to determine the most beneficial structure for their specific circumstances.

By establishing the right business entity from the outset, they can not only streamline their tax obligations but also position themselves for future growth and success.

Utilizing Tax-Advantaged Retirement Accounts

- Traditional IRA | 6,000 (under 50) or 7,000 (50 and over) | No age limit for contributions | Tax-deductible contributions, tax-deferred growth

- Roth IRA | 6,000 (under 50) or 7,000 (50 and over) | No age limit for contributions | Tax-free growth, tax-free withdrawals in retirement

- 401(k) | 19,500 (under 50) or 26,000 (50 and over) | 59 ½ for withdrawals without penalty | Tax-deferred contributions, potential employer match

For immigrant business owners, planning for retirement is an essential aspect of long-term financial health that should not be overlooked. Tax-advantaged retirement accounts such as Individual Retirement Accounts (IRAs) and Simplified Employee Pension (SEP) plans offer significant benefits by allowing individuals to save for retirement while reducing their taxable income in the present. Contributions made to these accounts are often tax-deductible, meaning that they can lower an entrepreneur’s overall tax liability while simultaneously building a nest egg for the future.

This dual benefit makes retirement accounts an attractive option for immigrant business owners who may be focused on immediate cash flow but also need to consider long-term financial stability. Furthermore, understanding the contribution limits and rules associated with these accounts is crucial for maximizing benefits. For instance, SEP IRAs allow higher contribution limits compared to traditional IRAs, making them particularly appealing for self-employed individuals or small business owners looking to save more aggressively for retirement.

Additionally, some retirement accounts offer investment options that can grow tax-deferred until withdrawal during retirement years when individuals may be in a lower tax bracket. By taking advantage of these retirement savings vehicles, immigrant entrepreneurs not only secure their financial future but also create a strategic approach to managing their current tax obligations.

Taking Advantage of Opportunity Zones

Opportunity Zones represent a relatively new investment vehicle designed to spur economic development in underprivileged areas while providing significant tax incentives for investors. For immigrant business owners looking to expand or invest in real estate or businesses located within these designated zones, the potential benefits are substantial. By investing capital gains into Opportunity Funds that focus on these areas, entrepreneurs can defer taxes on those gains until they sell their investment or until December 31, 2026—whichever comes first.

This deferral allows for greater liquidity and reinvestment opportunities in the short term. Moreover, if the investment is held for at least ten years, any additional gains accrued from the Opportunity Fund investment may be entirely exempt from federal taxes. This unique structure not only encourages long-term investment in economically distressed communities but also aligns with the goals of many immigrant entrepreneurs who seek to contribute positively to their local economies while benefiting from favorable tax treatment.

However, navigating the regulations surrounding Opportunity Zones requires careful planning and due diligence; thus, it is advisable for immigrant business owners to consult with financial advisors who specialize in this area to ensure compliance and maximize potential benefits.

Navigating State and Federal Tax Incentives

State-Level Incentives for Immigrant Entrepreneurs

For instance, some states provide incentives for businesses that create jobs or invest in renewable energy technologies. Understanding these state-level incentives is crucial for immigrant entrepreneurs who wish to optimize their financial strategies while contributing positively to their communities.

Federal Programs Supporting Economic Development

Furthermore, federal programs such as the New Markets Tax Credit (NMTC) program aim to stimulate investment in low-income communities by providing investors with a credit against federal income taxes for making equity investments in designated Community Development Entities (CDEs).

Maximizing Opportunities for Immigrant Business Owners

Immigrant business owners should actively research both state and federal incentives that align with their business goals and operational strategies. By leveraging these opportunities effectively, they can enhance their financial standing while simultaneously contributing to broader economic development initiatives.

Seeking Professional Tax Advice for Immigrant Business Owners

Given the complexities surrounding U.S. tax laws and regulations—especially for immigrant business owners—seeking professional tax advice is not just beneficial; it is often essential for ensuring compliance and optimizing financial outcomes. Tax professionals who specialize in working with immigrant entrepreneurs can provide invaluable insights into navigating both federal and state regulations while identifying potential savings through credits and deductions that may otherwise go unnoticed.

These experts can also assist in establishing appropriate business structures tailored to individual circumstances, ensuring that entrepreneurs make informed decisions that align with their long-term goals. Moreover, professional guidance becomes even more critical when dealing with international tax issues or navigating the intricacies of foreign investments and income reporting requirements. The stakes are high; missteps in tax compliance can lead to severe consequences that could jeopardize both personal and business finances.

By investing in professional tax advice, immigrant business owners not only safeguard themselves against potential pitfalls but also position themselves for sustainable growth and success in an increasingly competitive marketplace. Ultimately, informed decision-making backed by expert advice can empower these entrepreneurs to thrive while contributing positively to the economy at large.